1.1.9. Payout Transactions¶

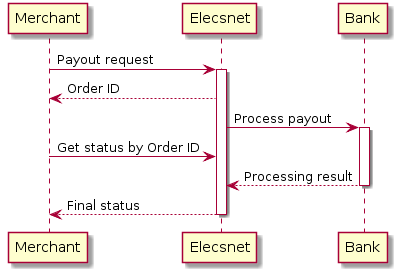

Process Payout transaction¶

The End point ID is an entry point for incoming Merchant’s transactions and is actually the only Elecsnet object which is exposed via API.

Payout Request Parameters¶

In order to initiate a Payout transaction Merchant sends an HTTPS POST request with the parameters specified in Payout Request Parameters Table below.

Note

| Payout Request Parameter | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier | Mandatory |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. For instance, 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro | Mandatory |

| order_desc | 64/String | Brief order description | Optional |

| ipaddress | 7-45/String | Customer’s IP address (IPv4 or IPv6) | Conditional* |

| purpose | 128/String | Payout purpose | Conditional* |

| server_callback_url | 128/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks | Optional |

| redirect_url | 128/String | URL the merchant or customer will be redirected to upon completion of the transaction. Please note that the user will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through user’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Used only in specific cases | Conditional* |

| redirect_success_url | 1024/String | URL the merchant or customer will be redirected to upon completion of the transaction. Please note that the user will be redirected only in case if the transaction is approved. You should not use this parameter to retrieve results from Elecsnet gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Used only in specific cases | Conditional* |

| redirect_fail_url | 1024/String | URL the merchant or customer will be redirected to upon completion of the transaction. Please note that the user will be redirected only in case if the transaction is declined or filtered. You should not use this parameter to retrieve results from Elecsnet gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Used only in specific cases | Conditional* |

| credit_card_number | 20/Numeric | Customer’s credit card number. Note: For the scenario of payment to a card inside the system, this card will be considered as a source, and all processing limits, lists and fraud scoring will be applied to it as a source card. | Conditional* |

| card_printed_name | 128/String | Customer’s full name, as printed on the card | Conditional* |

| expire_month | 2/Numeric | Credit card expiration month | Conditional* |

| expire_year | 4/Numeric | Credit card expiration year | Conditional* |

| cvv2 | 3-4/Numeric | Customer’s CVV2 code. CVV2 (Card Verification Value) is a three- or four-digit number AFTER the credit card number in the signature area of the card | Conditional* |

| account_number | 24/String | Account Number | Conditional* |

| account_name | 128/String | Bank account | Optional |

| ewallet_type | 64/String | Type of e-wallet | Conditional* |

| ewallet_wallet | 128/String | E-wallet ID | Conditional* |

| crypto_wallet_address | 64/String | Address of crypto wallet | Conditional* |

| bank_name | 255/String | Bank Name | Conditional* |

| bank_branch | 255/String | Bank Branch Name | Conditional* |

| bank_code | 32/String | Bank code | Conditional* |

| bank_city | 128/String | Bank city | Conditional* |

| bank_address1 | 255/String | Bank address | Conditional* |

| bank_zip_code | 255/String | Bank postal ZIP code | Conditional* |

| bank_province | 255/String | Bank province | Conditional* |

| bank_area | 255/String | Bank area | Conditional* |

| routing_number | 16/String | Routing number used to identify specific bank branches in China | Conditional* |

| legal_person_name | 128/String | Name on the legal document | Conditional* |

| legal_person_document_number | 128/String | Number of legal document | Conditional* |

| receiver_first_name | 128/String | Receiver first name, also can be sent as first_name | Conditional* |

| receiver_last_name | 128/String | Receiver last name, also can be sent as last_name | Conditional* |

| receiver_birthday | 30/Numeric | Receiver birthday, also can be sent as birthday | Conditional* |

| receiver_country_code | 3/String | Receiver country code, also can be sent as country | Conditional* |

| receiver_state | 4/String | Receiver state, should be provided for countries that have states (USA, Canada, Australia), also can be sent as state | Conditional* |

| receiver_city | 128/String | Receiver city, also can be sent as city | Conditional* |

| receiver_zip_code | 32/Numeric | Receiver zip code, also can be sent as zip_code | Conditional* |

| receiver_address1 | 256/String | Receiver address, also can be sent as address1 | Conditional* |

| receiver_phone | 128/Numeric | Receiver phone, also can be sent as phone | Conditional* |

| receiver_email | 128/String | Receiver E-mail, also can be sent as email | Conditional* |

| receiver_identity_document_id | 128/String | Receiver identity document identifier, also can be sent as identity_document_id | Conditional* |

| receiver_identity_document_number | 128/String | Receiver identity document number, also can be sent as identity_document_number | Conditional* |

| merchant_data | 64k/String | Any additional information for this transaction which may be useful in Merchant’s external systems, e.g. VIP customer, TV promo campaign lead. Will be returned in Status response and Merchant Callback | Optional |

| bank_bic | 128/String | BIC of the recipient’s bank | Conditional* |

| receiver_inn | 128/String | Recipient’s INN | Conditional* |

| card_recurring_payment_id | Long | Sender’s tokenized cardholder’s data ID. Send either card_recurring_payment_id or combination of credit_card_number, card_printed_name, expire_month and expire_year, not all. To create card_recurring_payment_id see Process Card Registration via v2/create-card-ref. Note: For the scenario of payment to a card inside the system, this card will be considered as a source, and all processing limits, lists and fraud scoring will be applied to it as a source card. | Optional |

Payout Request Example¶

account_number=1234567890

&amount=100

&bank_branch=test

&bank_name=test

&client_orderid=12345

¤cy=USD

&oauth_consumer_key=payout_test

&oauth_nonce=EqINVv5rkhx

&oauth_signature_method=HMAC-SHA1

&oauth_timestamp=1513785920

&oauth_version=1.0

&routing_number=123456

Payout Response¶

Note

| Payout Request Parameters | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details |

| paynet-order-id | Order id assigned to the order by Elecsnet |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by Elecsnet server to particular request from the Merchant |

| error-message | If status is error this parameter contains the reason for decline or error details |

| error-code | The error code is case of error status. |

Payout Response Example¶

type=async-response

&serial-number=00000000-0000-0000-0000-0000000624e8

&merchant-order-id=59e1e3ca-5d44-11e1-b3d6-002522b853b4

&paynet-order-id=94935

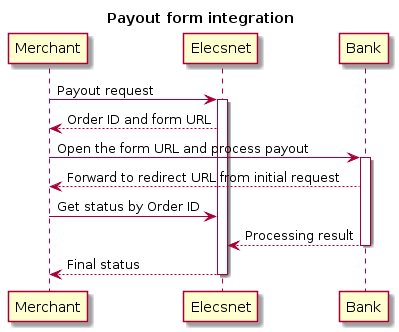

Process Payout Form transaction¶

The End point ID is an entry point for incoming Merchant’s transactions and is actually the only Elecsnet object which is exposed via API.

Payout Form Request Parameters¶

In order to initiate a Payout transaction Merchant sends an HTTPS POST request with the parameters specified in Payout Form Request Parameters Table below.

Note

| Payout Request Parameter | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier | Mandatory |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. For instance, 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro | Mandatory |

| order_desc | 64/String | Brief order description | Conditional* |

| ipaddress | 7-45/String | Customer’s IP address (IPv4 or IPv6) | Conditional* |

| purpose | 128/String | Payout purpose | Conditional* |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks | Optional |

| redirect_url | 1024/String | URL the merchant or customer will be redirected to upon completion of the transaction. Please note that the user will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from Elecsnet gateway, because all parameters go through user’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead | Mandatory if both redirect_success_url and redirect_fail_url are missing |

| redirect_success_url | 1024/String | URL the merchant or customer will be redirected to upon completion of the transaction. Please note that the user will be redirected only in case if the transaction is approved. You should not use this parameter to retrieve results from Elecsnet gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Used only in specific cases | Mandatory if redirect_url parameter is missing |

| redirect_fail_url | 1024/String | URL the merchant or customer will be redirected to upon completion of the transaction. Please note that the user will be redirected only in case if the transaction is declined or filtered. You should not use this parameter to retrieve results from Elecsnet gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Used only in specific cases | Mandatory if redirect_url parameter is missing |

| account_number | 24/String | Account Number | Conditional* |

| account_name | 128/String | Bank account | Conditional* |

| ewallet_type | 64/String | Type of e-wallet | Conditional* |

| ewallet_wallet | 128/String | E-wallet ID | Conditional* |

| crypto_wallet_address | 64/String | Adress of crypto wallet | Conditional* |

| bank_name | 255/String | Bank Name | Conditional* |

| bank_branch | 255/String | Bank Branch Name | Conditional* |

| bank_code | 32/String | Bank code | Conditional* |

| bank_address1 | 255/String | Bank address | Conditional* |

| bank_zip_code | 255/String | Bank postal ZIP code | Conditional* |

| bank_province | 255/String | Bank province | Conditional* |

| bank_area | 255/String | Bank area | Conditional* |

| routing_number | 16/String | Routing number used to identify specific bank branches in China | Conditional* |

| legal_person_name | 128/String | Name on the legal document | Conditional* |

| legal_person_document_number | 128/String | Number of legal document | Conditional* |

| receiver_first_name | 128/String | Receiver first name, also can be sent as first_name | Conditional* |

| receiver_last_name | 128/String | Receiver last name, also can be sent as last_name | Conditional* |

| receiver_birthday | 30/Numeric | Receiver birthday, also can be sent as birthday | Conditional* |

| receiver_country_code | 3/String | Receiver country code, also can be sent as country | Conditional* |

| receiver_state | 4/String | Receiver state, should be provided for countries that have states (USA, Canada, Australia), also can be sent as state | Conditional* |

| receiver_city | 128/String | Receiver city, also can be sent as city | Conditional* |

| receiver_zip_code | 32/Numeric | Receiver zip code, also can be sent as zip_code | Conditional* |

| receiver_address1 | 256/String | Receiver adress, also can be sent as address1 | Conditional* |

| receiver_phone | 128/Numeric | Receiver phone, also can be sent as phone | Conditional* |

| receiver_email | 128/String | Receiver E-mail, also can be sent as email | Conditional* |

| receiver_identity_document_id | 128/String | Receiver identity document identifier, also can be sent as identity_document_id | Conditional* |

| receiver_identity_document_number | 128/String | Receiver identity document number, also can be sent as identity_document_number | Conditional* |

| merchant_data | 64k/String | Any additional information for this transaction which may be useful in Merchant’s external systems, e.g. VIP customer, TV promo campaign lead. Will be returned in Status response and Merchant Callback | Optional |

| merchant_form_data | 128/String | Parameters sent in merchant_form_data API parameter are parsed into macros with the same name, the parameter is url-encoded, example: testparam%3Dtest1%26mynewparam%3Dtest2 and is parsed into $MFD_testparam = test1 and $MFD_mynewparam = test2 macros in the form. Parameter name characters[a-zA-Z0-9], parameter value characters[a-zA-Z0-9], control characters [=&], 2MB max size. For example, this parameter can be used to display payment form in light/dark mode depending on the value passed by Connecting Party (e.g. pass merchant_form_data=theme%3Ddark in request and $MFD_theme macro placeholder on payment form will be changed to dark. | Optional |

| preferred_language | 2/String | Preferred language | Optional |

| bank_bic | 128/String | BIC of the recipient’s bank | Conditional* |

| receiver_inn | 128/String | Recipient’s INN | Conditional* |

| card_recurring_payment_id | Long | Sender’s tokenized cardholder’s data ID. Send either card_recurring_payment_id or combination of credit_card_number, card_printed_name, expire_month and expire_year, not all. To create card_recurring_payment_id see Process Card Registration via v2/create-card-ref | Optional |

Payout Form Request Example¶

account_number=1234567890

&amount=100

&bank_branch=test

&bank_name=test

&client_orderid=12345

¤cy=USD

&oauth_consumer_key=payout_test

&oauth_nonce=EqINVv5rkhx

&oauth_signature_method=HMAC-SHA1

&oauth_timestamp=1513785920

&oauth_version=1.0

&routing_number=123456

Payout Form Response¶

Note

| Payout Request Parameters | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details |

| paynet-order-id | Order id assigned to the order by Elecsnet |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by Elecsnet server to particular request from the Merchant |

| error-message | If status is error this parameter contains the reason for decline or error details |

| error-code | The error code is case of error status |

| redirect_url | The URL to the page where the Merchant should redirect the client’s browser. Merchant should send HTTP 302 redirect, see General Payment Form Process Flow |

Payout Form Response Example¶

type=async-response

&serial-number=00000000-0000-0000-0000-0000000624e8

&merchant-order-id=59e1e3ca-5d44-11e1-b3d6-002522b853b4

&paynet-order-id=94935

&redirect_url=https://sandbox.elecsnet.ru/paynet/form/init/BB411111...222

Payout and payout-form requests authorization¶

OAuth realm="",

oauth_version="1.0",

oauth_signature_method="HMAC-SHA1",

oauth_consumer_key="merchantlogin",

oauth_timestamp="1513785920",

oauth_nonce="EqINVv5rkhx",

oauth_signature="9bSeUoR5yJSSJ4KPhotT%2BofEHSQ%3D"

Testing account_number values:

- account_number = 1234567890 to get APPROVED

- account_number = 0987654321 to get DECLINED

- account_number = 1987654321 to get PROCESSOR_INTERNAL_ERROR

Order status¶

Merchant must use Order status API call to get the customer’s order transaction status. After any type of transaction is sent to Elecsnet server and order id is returned, Merchant should poll for transaction status. When transaction is processed on Elecsnet server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

For integration purposes use staging environment sandbox.elecsnet.ru instead of production pay.elecsnet.ru. Status API calls are initiated through HTTPS POST request by using URL in the following format:

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration. https://pay.elecsnet.ru/paynet/api/v2/status/ENDPOINTID

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration. https://pay.elecsnet.ru/paynet/api/v2/status/group/ENDPOINTGROUPID

Order status call parameters¶

Note

| Status call parameters | Description |

|---|---|

| login | Merchant login name |

| client_orderid | Merchant order identifier of the transaction for which the status is requested |

| orderid | Order id assigned to the order by Elecsnet |

| by-request-sn | Serial number assigned to the specific request by Elecsnet. If this field exist in status request, status response return for this specific request |

| control | Checksum used to ensure that it is Elecsnet (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order status API call authorization through control parameter for more details about generating control checksum |

Order Status Response¶

Note

| Status Response Parameter | Description |

|---|---|

| type | The type of response. May be status-response |

| status | See Status List for details |

| amount | Amount of the initial transaction |

| paynet-order-id | Order id assigned to the order by Elecsnet |

| merchant-order-id | Merchant order id |

| phone | Customer phone |

| html | HTML code of 3DS authorization form, encoded in application/x-www-form-urlencoded MIME format. Merchant must decode this parameter before showing the form to the Customer. The Elecsnet System returns the following response parameters when it gets 3DS authorization form from the Issuer Bank. It contains auth form HTML code which must be passed through without any changes to the client’s browser. This parameter exists and has value only when the redirection HTML is already available. For non-3DS this never happens. For 3DS HTML has value after some short time after the processing has been started |

| redirect-to | For 3DS authorization the merchant can redirect the customer to URL provided in this parameter using GET HTTP method instead of rendering the page provided in html parameter. The redirect-to parameter is returned only if the html parameter is returned. This parameter must be used to work with 3DS 2.0 |

| serial-number | Unique number assigned by Elecsnet server to particular request from the Merchant |

| last-four-digits | Last four digits of customer credit card number |

| bin | Bank BIN of customer credit card number |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc) |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled) |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled) |

| transaction-type | Transaction type (sale, reversal, capture, preauth) |

| processor-rrn | Bank Receiver Registration Number |

| processor-tx-id | Acquirer transaction identifier |

| receipt-id | Electronic link to receipt https://pay.elecsnet.ru/paynet/view-receipt/ENDPOINTID/receipt-id/ |

| name | Cardholder name |

| cardholder-name | Cardholder name |

| card-exp-month | Card expiration month |

| card-exp-year | Card expiration year |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks |

| card-country-alpha-three-code | Three letter country code of source card issuer. See Country Codes for details |

| Customer e-mail | |

| first-name | Customer’s first name |

| last-name | Customer’s last name |

| country * | Customer’s country (two-letter country code). Please see Country Codes for a list of valid country codes. |

| state * | Customer’s state . Please see Country Codes for a list of valid state codes. Mandatory for USA, Canada and Australia. |

| city * | Customer’s city |

| zip_code * | Customer’s ZIP code |

| address1 * | Customer’s address line 1 |

| bank-name | Bank name by customer card BIN |

| terminal-id | Acquirer terminal identifier to show in receipt |

| paynet-processing-date | Acquirer transaction processing date |

| approval-code | Bank approval code |

| order-stage | The current stage of the transaction processing. See Order Stage for details |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available |

| loyalty-message | The message from the loyalty program. if available |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available |

| loyalty-program | The name of the loyalty program for current operation. if available |

| descriptor | Bank identifier of the payment recipient |

| original-gate-descriptor | Descriptor, which is set on gate level in the system |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline |

| error-code | The error code is case status in declined, error, filtered |

| by-request-sn | Serial number from status request, if exists in request. Warning parameter amount always shows initial transaction amount, even if status is requested by-request-sn |

| verified-3d-status | See 3-D Secure Status List for details |

| eci | Electronic Commerce Indicator (Visa) |

| ips-src-payment-product-code | Code for card set by multinational financial service. (Visa/Mastercard) |

| ips-src-payment-product-name | Decrypted code for card set by multinational financial service. (Visa/Mastercard) |

| ips-src-payment-type-code | Type of card code set by multinational financial service. (Visa/Mastercard) |

| ips-src-payment-type-name | Decrypted code for type of card set by multinational financial service. (Visa/Mastercard) |

| initial-amount | Amount, set in initiating transaction, without any fees or commissions. This value can’t change during the transaction flow |

| seller-commission | Total commission for processed transaction. This is optional parameter. Please contact your manager in Elecsnet, if you would like to receive it |

| acquirer-commission | Acquirer commission for processed transaction. This is optional parameter. Please contact your manager in Elecsnet, if you would like to receive it |

| motivational-message | This is an optional message which contains extended information about the reason for the declined transaction. |

| transaction-date | Date of final status assignment for transaction. |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-0000005b5044

&merchant-order-id=902B4FF5

&processor-tx-id=PNTEST-159884

&paynet-order-id=159884

&status=approved

&amount=10.42

&descriptor=test-usd

&original-gate-descriptor=test 12345678 3Ds Bank

&gate-partial-reversal=enabled

&gate-partial-capture=enabled

&transaction-type=sale

&receipt-id=a5061379-6ff5-3565-a9ba-1b8a814d04f6

&name=TEST HOLDER

&cardholder-name=TEST HOLDER

&card-exp-month=1

&card-exp-year=2016

&email=john.smith@gmail.com

&last-name=Smith

&first-name=John

&processor-rrn=510321889824

&approval-code=242805

&order-stage=sale_approved

&last-four-digits=9001

&bin=520306

&card-type=MASTERCARD

&phone=12063582043

&bank-name=CITIBANK

&paynet-processing-date=2015-04-09 17:14:26 MSK

&by-request-sn=00000000-0000-0000-0000-0000005b2a8a

&card-hash-id=1493114

&card-country-alpha-three-code=RUS

&verified-3d-status=AUTHENTICATED

&ips-src-payment-product-code=SAP

&ips-src-payment-product-name=SAP—Platinum Mastercard® Salary– Immediate Debit

&ips-src-payment-type-code=Debit

&ips-src-payment-type-name=MASTERCARD Debit

&initial-amount=10.42

&transaction-date=2023-01-10+12%3A46%3A28+MSK

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to Elecsnet. This SHA-1 checksum, the parameter control, is created by concatenating of the values of the parameters in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example assume the following values are corresponds the parameters above:

| Parameter Name | Parameter Value |

|---|---|

| login | cool_merchant |

| client_orderid | 5624444333322221111110 |

| orderid | 9625 |

| merchant_control | r45a019070772d1c4c2b503bbdc0fa22 |

The complete string example may look as follows:

cool_merchant56244443333222211111109625r45a019070772d1c4c2b503bbdc0fa22

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

c52cfb609f20a3677eb280cc4709278ea8f7024c

Server callback result¶

Upon completion of request processing by the System it returns the result on the specified server_callback_url with the parameters described in Merchant Callbacks

The checksum is used to ensure that the callback is initiated for a particular Merchant, and not for anybody else claiming to be such Merchant. This SHA-1 checksum, the control parameter, is created by concatenation of the parameters’ values in the following order:

- status

- orderid

- client_orderid

- merchant_control

A complete string example may look as follows:

approvedS279G323P4T1209294c258d6536ababe653E8E45B5-7682-42D8-6ECC-FB794F6B11B1

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter. For the above-mentioned example the control will take the following value:

e04bd50531f45f9fc76917ac78a82f3efaf0049c

All parameters are sent via GET method.

For more information, see Merchant Callbacks